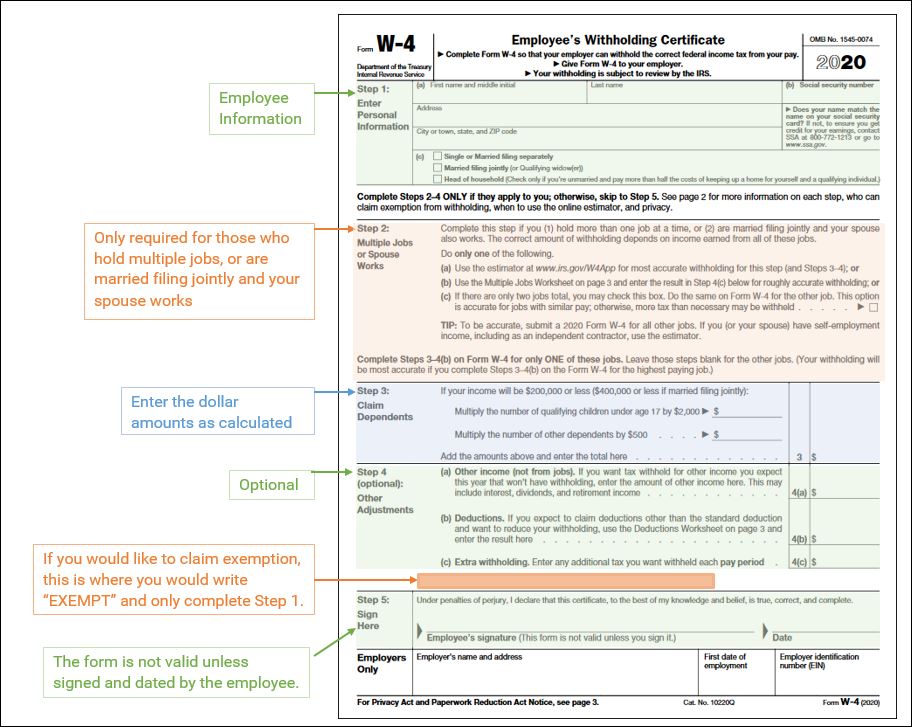

Form W4, Employee’s Withholding Certificate, has substantially changed as of January 1, 2020. It has been redesigned to increase the transparency and accuracy of the IRS withholding system, and to comply with the withholding requirements of the Tax Cuts and Jobs Act. The most significant change is that allowances no longer exist.

What do I do?

The new form impacts all employees hired after January 1, 2020, as well as current employees who want to make changes to their federal tax withholding. Please only use the new Form W4, Abacus will not accept any prior versions of the W4.

Tools

Employees can use the IRS Tax Withholding Estimator to check their withholding and ensure that the right amount of tax is being withheld from their paycheck.